Opinion piece by Dee Hung

The rocketing growth of China’s P2P lending business has attracted much overseas attention. According to one article from Reuters 1 in 2018, the size of China’s P2P industry was greater than the total for all other countries in the world. The outstanding loans in China were RMB 1.49 trillion (~GBP 171 billion).

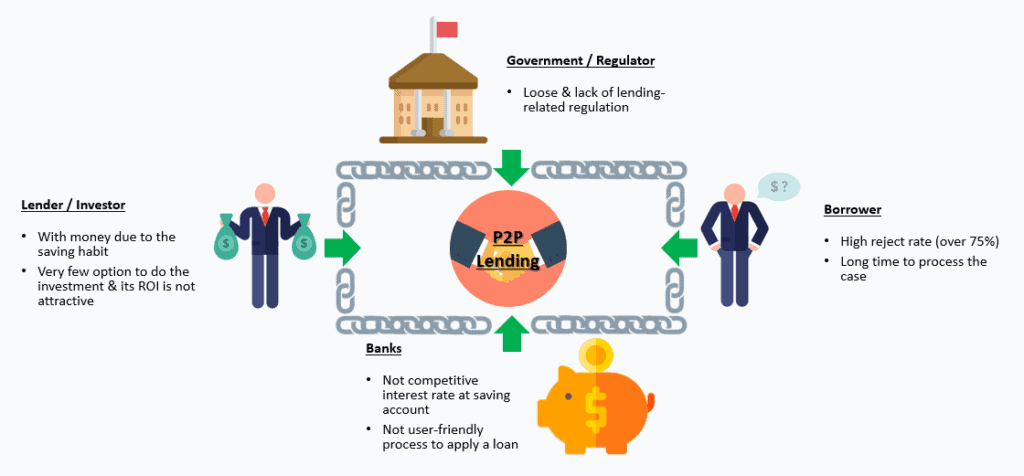

Foreigners considered this success to be the result of the maturity of fintech or changes in consumer behaviour. The following three forces contributed to the growth of P2P lending in China:

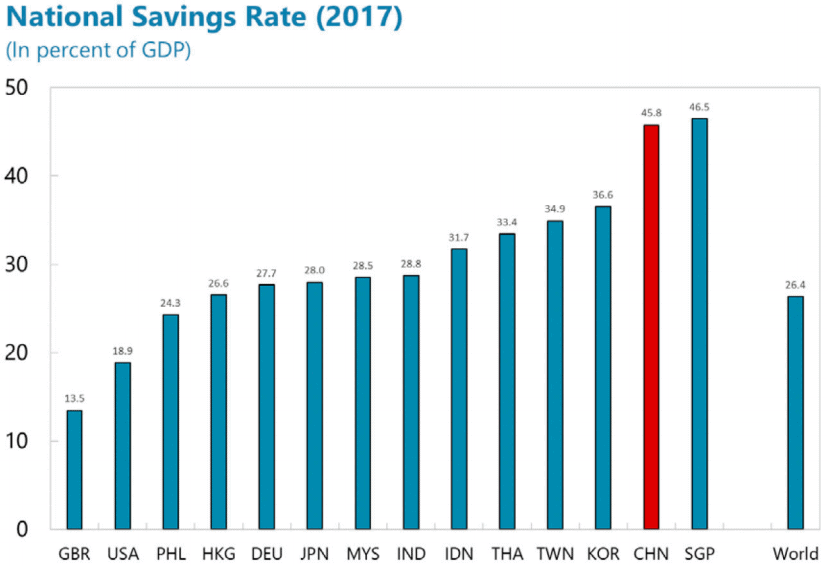

- High National Saving rate, at 46% of GDP

Based on an International Monetary Fund (IMF) report in 2018 2, China has the 2nd highest levels of savings in the world. In fact, China was continually been in the top 5 over the past 8 years.

Graph credit: IMF 2018 report

- Looseness & Lack of Lending-related Regulation Before 2016

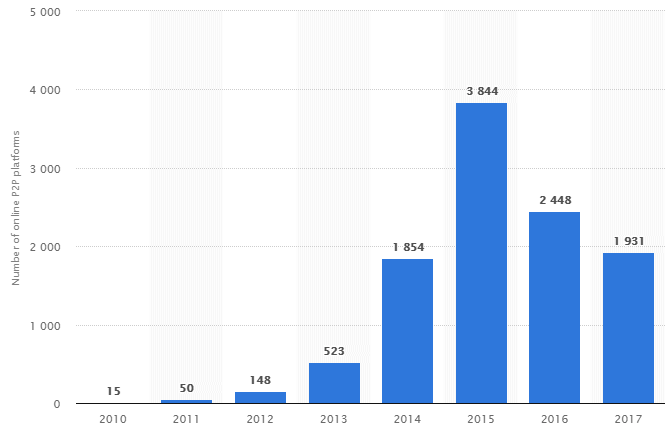

The number of P2P lending platforms increased from 15 to 3,844 during the period from 2010 to 2015 according figures from to Statista.com. The number of service provider dropped subsequently. The number of companies in 2017 was still higher than in 2014 3.

Graph credit: Statista 2017 report

- Unmet financial demands

The Chinese financial system is dominated by the banking sector – responsible for almost 75% of the economy’s capital, a much higher percentage when compared to the average of less than 20% in developed countries 4. This implies the country is heavily dependent on the banking system for capital allocation.

In a recent interview conducted with Bloomberg Jack Ma said “… the loan approval rate at MYBank is four times higher than traditional lenders, which typically reject 80% of small-business loan request and take at least 30 days to process applications.” 5

A Perfect Business Ecosystem Was Formed In China Before 2016

The Chain Is Broken

In early 2016 the Ezubao (e租宝) Ponzi 6 scheme scandal launched the destruction of the ecosystem. The company was established in July 2014. The scheme promised to pay investors interest rates of between 9% and 14.6%, much higher than those offered by banks. As of 1st February 2016, the scheme was closed down. It attracted 50 billion yuan (~ GBP 5.6 billion) from 900,000 investors 7.

40% of P2P Lending Platforms were Ponzi Schemes

Since the 2016 report of China Banking and Insurance Regulatory Commission (CBRC) 8, there was a shrinking of the market following the case of Ezubao. A significant number of P2P Lending service providers were illegal or problematic. The release of the report coincided with the introduction of over 100 new rules by the authority.

Even though these rules were gradually implemented, lenders lost the confidence of the market. This prompted investors to withdraw their money quickly (companies did not maintain reserve capital – it was not a legal requirement to keep certain good ratios as with banks) and as a result businesses shut down. This domino effect spread throughout the entire P2P lending industry and exists even today. The following table illustrates the level of impact as of February 2019 9:

| Year | # of P2P Lending Platforms that went bust or werefound to be problematic | # of investors involved (thousand people) | Outstanding P2P loans involved (RMB billion) |

| 2014 | 395 | 63 | 6.84 |

| 2015 | 1,686 | 272 | 16.79 |

| 2016 | 3,407 | 454 | 26.59 |

| 2017 | 4,129 | 576 | 33.24 |

| 2018 | 5,417 | 2,154 | 176.65 |

| 2019 (up to Feb) | 5,433 | 2,162 | 177.21 |

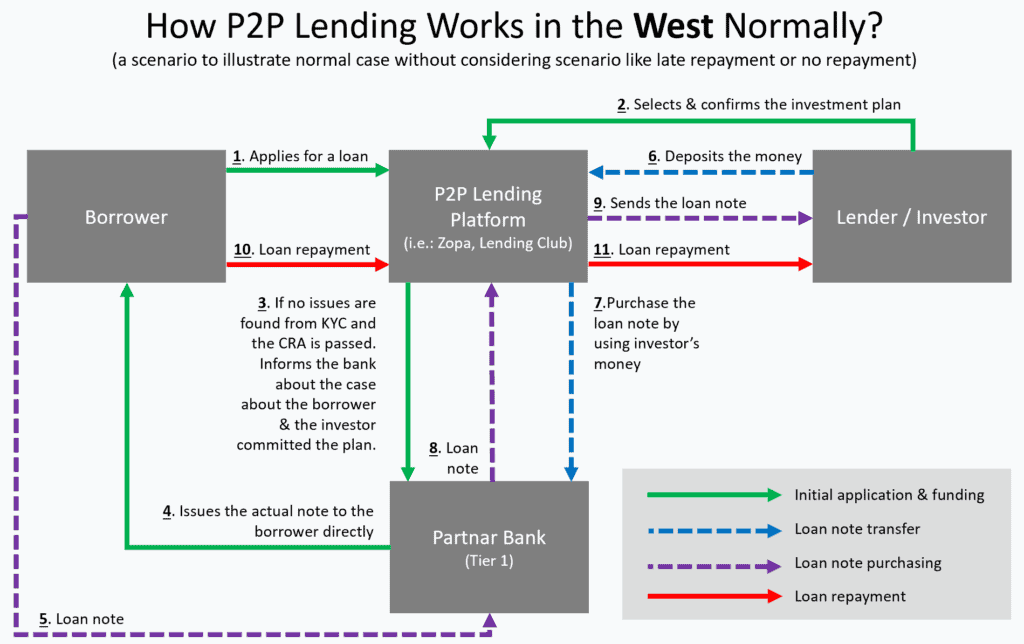

Differences between business models in the West and China

| Item | How P2P Lending Usually Worked in China Before 2016 |

| Partner Bank (Tier 1) | Not a legal requirement to use banks. If banks are involved, they can be of any type (i.e.: shadow bank) |

| Step 2 – confirms the investment plan | Uncommon to have a dedicated in-house compliance or legal staff and check investors’ background. |

| Step 3 – KYC & CRA and the way of to communicate to the third party | Lack of a proper CRA (Client Risk Assessment) in place. In an extreme case, no CRA at all. No advanced algorithm to analyse the borrower’s needs and the investment plan from the lender/ investor. It is a simple match but money only.Rare to update the Partner with info from the borrower and the investor – only the amount of money required by the borrower. |

| Step 4 – Issue the actual note to the borrower | No standard procedure. P2P lending firms manage this step differently.[If the bank does exist] it sends the money to the P2P lending firm. The firm transfers the money to the borrower instead. Sometimes the P2P lending firm might use other sources of money to transfer to the borrower[If the bank does not exist] the P2P lending firm allocates the source for transfer. |

| Step 5 – Issue the note to the borrower | Might not have this step [refer to Partner Bank (Tier 1) |

| Step 6 – Investor deposits the money | No standard procedure. P2P lending firms manage this step differently.Sometimes it requires the investor’s the money at the beginning even though there is no borrowerIf the investor deposits the money, then money might not be deposited at a segregated account. Might not have this step |

| Step 7 – Purchase the loan note by using investor’s money | Might not have this step [refer to Partner Bank (Tier 1) |

| Step 8 – A loan note from the Partnar bank to P2P Lending firm | Might not have this step [refer to Partner Bank (Tier 1) |

| Step 9 – Issue the note to the borrower | Not a legal requirement. P2P lending platform makes the decision. It is not a loan note format. |

Conclusion

Katie Chen (Director at Fitch Ratings) said in an interview with SCMP in April 201910, that “when the water is deep, the problems are covered up and invisible. But stronger regulation lowered the water table and exposed the problems.”

In the past, the main reason foreigners misunderstood lending in China was simply that the reality was hidden under the water.

Back to today’s China, is it better for everyone to understand the full picture? From an ecosystem perspective it has changed, but there are a few items that are not transparent enough such as the ways that P2P lending platforms match borrowers and lenders, and procedures for KYC and CRA.

There is one important part that we are still all missing here however – and that’s advertising and promotion.

– With assistance by Sergey Tsvetkov

- Reuters, Beijing struggles to defuse anger over China’s P2P lending crisis, https://www.reuters.com/article/us-china-lenders-p2p-insight/beijing-struggles-to-defuse-anger-over-chinas-p2p-lending-crisis-idUSKBN1KX077, 12 August 2018

- IMF Working Paper, China’s High Savings: Drivers, Prospects, and Policies, https://www.imf.org/~/media/Files/Publications/WP/2018/wp18277.ashx, Dec 2018

- Statista, Number of online peer-to-peer (P2P) lending platforms in China from 2010 to 2017, https://www.statista.com/statistics/652720/china-online-p2p-lending-platform-count/, 13 September 2019

- The New York Times, Online Lender Ezubao Took $7.6 Billion in Ponzi Scheme, China Says, https://www.nytimes.com/2016/02/02/business/dealbook/ezubao-china-fraud.html?mcubz=0, 1 February 2016

- livemint.com, Jack Ma’s 3-minute loans are changing China’s banking, https://www.livemint.com/news/world/jack-ma-s-290-billion-loan-machine-is-changing-chinese-banking-1564315968589.html, Jul 2019

- Centre for Financial Regulation and Economic Development, Online P2P Lending and Regulatory Responses in China: Opportunities and Challenges, https://www.law.cuhk.edu.hk/en/research/cfred/download/CFRED_WP21_Robin_Hui_Huang.pdf, August 2017

- Log Angeles Times, Chinese company lived the high life — until it all came crashing down, https://www.latimes.com/world/asia/la-fg-china-shadow-banking-20160203-story.html, 3 February 2016

- China Banking and Insurance Regulatory Commission, Economic & Banking Development (Part One) http://www.cbrc.gov.cn/chinese/files/2018/529E627CE8324461BD37CE152929E9BE.pdf, 2017

- TechNode, China’s online P2P lending industry is undergoing a massive shake out, https://technode.com/2019/02/21/chinas-online-p2p-lending-industry-is-undergoing-of-a-massive-shake-out, Feb 2019

- SCMP, China’s P2P lending market could be decimated this year amid Beijing crackdown, https://www.scmp.com/economy/china-economy/article/3006170/chinas-p2p-lending-market-could-be-decimated-year-amid, 15 April 2009

About Dee Hung

Dee Hung was born and raised in Hong Kong, China. He obtained a bachelor’s (Hons) in Information Technology and a Master of Business Administration (MBA) from Hong Kong. Dee relocated to London, United Kingdom in 2015.

Dee’s last position was the Head of UX and Marketing at Acetop Financial (UK), regulated by FCA. Acetop shares a close link to iGold – the largest gold trader (CFD) in China. Dee also served the largest Canadian financial firm Manulife, the largest Japanese Insurance firm MSIG and as a passionate digital marketer founded (2013) the Digital Marketing Association (HKDMA) in Hong Kong.