A round-up of China’s top financial headlines as of Wednesday, 12 July, 2023.

The latest official data from China’s central bank points to a leap in lending for the month of June, with policymakers driving greater support for the national economy as it continues to recover from pandemic-related impacts. CPI has held steady, while PPI has declined by over 5%.

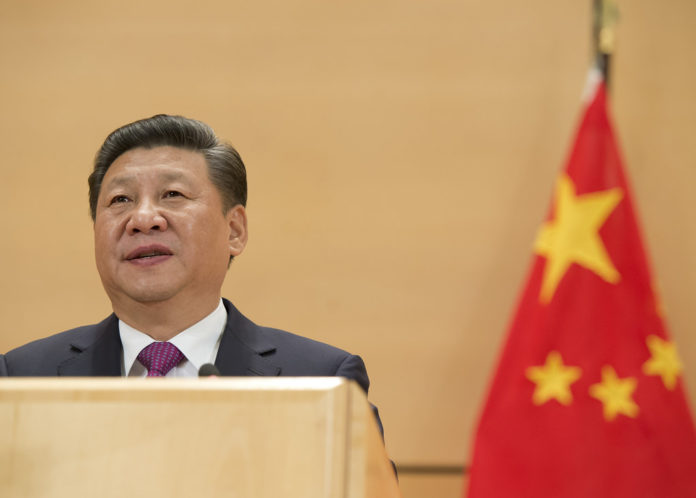

President Xi Jinping has approved a raft of measures including a directive to drive further opening of the Chinese economy, with a focus on investment, trade, finance and innovation.

Central state-owned enterprises (SOEs) accounted for well over half of the dividends issued by listed companies in China last year, while the number of private enterprises in China has exceeded 50 million.

China has launched reforms of fees levied by mutual funds, alongside new regulations for private equity investment funds.

Ahead of expectations! What signals does China’s latest financial data send? (Securities Daily)

“On July 11, the People’s Bank of China released its financial data report for the first half of 2023. Its figures indicate that in the first half of the year, renminbi loans increased by 15.73 trillion yuan, for a rise of 2.02 trillion yuan compared to the same period last year.

“New credit increased significantly for June, hitting a record high for the period. Both corporate and household lending increased significantly, while bill financing decreased in year-on-year terms and the credit structure significantly optimized.

“Renminbi loans increased by 3.05 trillion yuan that month, for a rise of 229.6 billion yuan compared to the same period last year.

“Broken down by sector, Wind data indicates that in June, lending to enterprises (institutions) increased by 2.28 trillion yuan, for a rise of 68.7 billion yuan year-on-year and 1.42 trillion yuan month-on-month.

“Corporate short-term loans and medium- and long-term loans increased by 744.9 billion yuan and 1.59 trillion yuan respectively.

“In June, household loans increased by 963.9 billion yuan, a sharp rise of 115.7 billion yuan compared to the same period last year. Household short-term loans and medium- and long-term loans increased by 491.4 billion yuan and 463 billion yuan respectively.

“In the first half of the year, the cumulative increase in total social financing was 21.55 trillion yuan, 475.4 billion yuan more than the same period last year. In June the total social financing increase was 4.22 trillion yuan, 2.67 trillion yuan more than the previous month, and 985.9 billion yuan less than the same period last year.

“Wen Bin, chief economist at China Minsheng Bank, said that the financial data indicates that credit increased significantly in June and the credit structure has further optimized. However, a number of recent economic data points indicate that there is an urgent need for further strengthening and stabilization of policies.

“Economic stabilisation policies will gradually strengthen in the near-future. Policy strengthening will drive the stable expansion of credit in the second half of the year, further boost the confidence of market players, stimulate endogenous investment and consumer demand, and consolidate the foundations for a steady economic recovery.”

Xi Jinping calls for new economic model with high level of opening (CCTV)

“Xi Jinping presided over the second meeting of the Central Committee for Comprehensively Deepening Reform on the afternoon of July 11.

“The meeting discussed and passed the ‘Opinions on Establishing a New Economic System with a Higher Level of Opening to Drive the Construction of New Development Conditions.’

“Xi Jinping stressed that the establishment of a new economic system with a higher level of opening is a strategic measure to promote reform and development through opening up.

“We must build a new development pattern based around services, stress institutional opening, and focus on deepening institutional reform in the key areas for foreign interaction and cooperation including investment, trade, finance and innovation.

“[We must] improve accompanying policy measures, and actively raise China’s external opening to a new level.”

June CPI holds steady, PPI falls 5.4% (Yicai)

“According to data released by the National Bureau of Statistics today, consumer prices in June remained flat in year-on-year terms and edged lower 0.2% over the previous month.

“In June, the national industrial producer price index (PPI) fell by 5.4% in year-on-year terms and 0.8% month-on-month.”

Dividends of listed central state-owned enterprises exceeded 1 trillion yuan last year, accounting for 56% market share (National Business Daily)

“In 2022, the total dividends of listed central government state-owned enterprises exceeded 1 trillion yuan, accounting for 56% of the entire market and occupying a dominant position.

“The number of listed state-owned enterprises that pay dividends accounted for nearly 80% of all listed state-owned enterprises. The average dividend payment rate has reached 40%, and the average dividend rate has also reached 3.5%, providing an excellent demonstration effect for the capital market.”

China’s private enterprises break through 50 million (People’s Daily)

“The State Administration for Market Regulation announced on 9 July that the number of registered private enterprises in China exceeded 50 million in early April and reached 50.9276 million by the end of May, for a 3.7-fold increase compared with the end of 2012 (10.857 million).

“Their share has increased from 79.4% to 92.4%, and their status and role in the development of the national economy have been further enhanced.

“An official from the Registration Bureau of the State Administration of Market Regulation said that since the start of this year, the development of private enterprises in China has recovered and shown strong resilience and vitality.

“In the first five months of 2023, 3.764 million new private enterprises were established nationwide, for a year-on-year increase of 17.2%, 6.5 percentage points faster than the growth rate for the first quarter.

“Regional development tends to be balanced. As of the end of May, there were 28.229 million, 10.507 million, 9.793 million, and 2.398 million registered private enterprises in the four major regions of eastern China, central China, western China, and northeastern China, accounting for shares of 55.4%, 20.6%, 19.2%, and 4.7%.

“The five provinces with the largest number of private enterprises are Guangdong, with 6.968 million enterprises; Shandong, with 4.347 million enterprises; Jiangsu, with 3.845 million enterprises; Zhejiang with 3.200 million households; and Henan, with 2.599 million enterprises.”

Reform of mutual fund fees kicks off – what impact will this have on A-shares? (Sina)

“Reform of the fee rates for publicly offered funds has started, with a focus on fixed rate products.

“Analyzing the fee rate reform measures, they mainly reduce the level of fees for active equity funds. For both newly registered fund products and outstanding fund products, the management fee rate and custody fee rate shall not exceed 1.2% and 0.2% respectively.

“Although the decline is not that large compared with the previously stipulated fee rate, it’s at least a good start and a sign of a reduction in the burden on fund investors.

“In terms of direct impacts, the reform of the fee rates for publicly offered funds will help reduce the holding cost for fund investors and reduce the cost pressure of taxes and fees.

“At the same time, due to the influence of the decline in holding costs, the attractiveness of fund products will be further enhanced, and more marginal funds will be drawn to the market.”

Regulations on the Supervision and Administration of Private Equity Funds Released to Regulate Fundraising and Investment Operations (Securities Journal)

“Premier Li Qiang recently signed an order of the State Council promulgating the ‘Regulations on the Supervision and Administration of Private Equity Investment Funds’, which will come into force on September 1, 2023.

‘The Party Central Committee and the State Council attach great importance to the development of the private equity investment sector as well as risk prevention and control. In recent years, China’s private equity investment fund sector has developed steadily, playing an active role in increasing the share of direct financing and promoting economic development.

“These special administrative regulations bring the activities of private equity investment funds within the remit of lawful and standardised supervision. Their goal is to encourage the standardized and healthy development of the private equity sector, better protect the legitimate rights and interests of investors, and further employ the sector’s role in serving the real economy and promoting technological innovation.

“Data show that as of May 2023, there were 22,000 private equity fund managers registered with the Asset Management Association of China, with 153,000 funds under management and a fund scale of about 21 trillion yuan.”

About China Banking News

First established in 2017, China Banking News (www.chinabankingnews.com) is a premium provider of news and intelligence on Chinese economic and financial policy for an English-speaking audience.

In addition to syndicated briefings and reports, China Banking News is also available for bespoke research and commissioned reports.

We welcome any feedback, recommendations or advice with regard to the contents and quality of our research reports.

Please contact us at editor@chinabankingnews.com

© Copyright 2023 CBAN Media. All Rights Reserved

China Banking News endeavours to ensure the information provided in this publication is accurate and up-to-date. No legal liability can be attached as to the contents hereof. This report is intended for general guidance and information purposes only. This report is under no circumstances intended to be used or considered as financial or investment advice.